Most popular questions

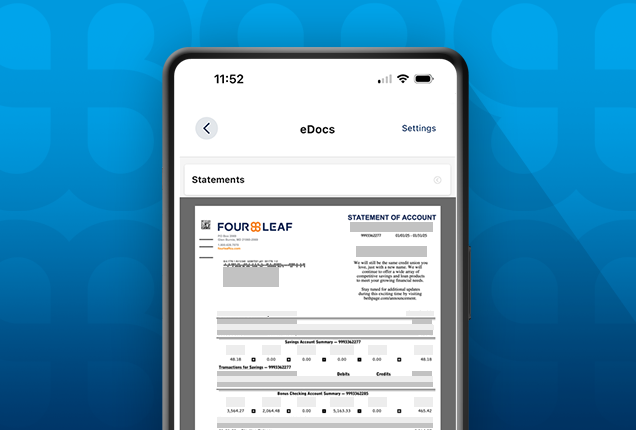

Tax statements (1099s) are mailed to members in late January, at which time they are also available in Digital Banking. You can view your tax statements online by logging into Online Banking and going to eStatements/Notices. Login here

Not yet signed up for Online Banking? Register now by clicking here.

View the eStatements Demo for additional guidance, or the Online Banking Demo, for enrollment details.

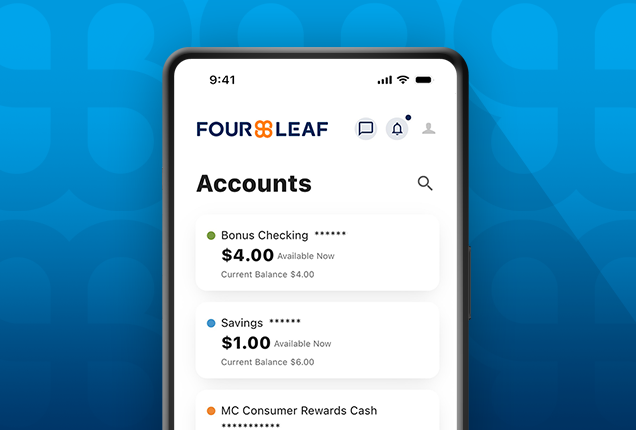

1. Log in to Online Banking or the FourLeaf Mobile App

2. Select “View your EStatements” from the Accounts Section in Online Banking or

select “Accounts” from the “More” section in the App

3. Select the Statements button

4. Click View Statements

5. A list of all document types available will appear

6. Select Tax Forms to view available tax statements

For additional guidance, refer to the Online Banking Demo for enrollment details and view the eStatements Demo, for instructions on accessing your statements.

Yes, to view previous years’ tax statements, log into Online Banking and go to Tax Forms in the Statements section.

Yes, you will still receive a paper tax statement.

You will get a tax document in the mail. If you have multiple active accounts, you can also view tax documents in the Statements section of Online Banking.

You will receive a tax document if you:

- Earned $10.00 or more in interest, dividends, and/or had proceeds from a sale

- Had IRA distributions, withholdings, or an indirect rollover

- Made an IRA Contribution

Depending on your account types or transactions performed during the last tax year, the following tax statements (and others) may be available:

- 1098: Mortgage Interest Statement – members who paid interest on a FourLeaf mortgage

or home equity loan - 1099-INT: Interest Income – members who earned $10 or more in dividends on FourLeaf accounts in 2025

Yes, the IRS’s Volunteer Income Tax Assistance (VITA) / Tax Counseling for the Elderly (TCE) Program offers free basic tax return preparation to qualified individuals and will be available in 2026. To learn more, visit fourleaffcu.com/vita.

Have confidential or account-related questions? Speak with a Call Center representative.

800 628 7070

Mon – Fri: 7:30 AM – 7:00 PM (ET)

Sat: 8:00 AM – 2:00 PM (ET)

The IRS’s Volunteer Income Tax Assistance (VITA) / Tax Counseling for the Elderly (TCE) Program offers free basic tax return preparation to qualified individuals.

Explore Digital Banking Demos

View the full library of tutorials and demos to help you manage all aspects of FourLeaf’s digital banking services.